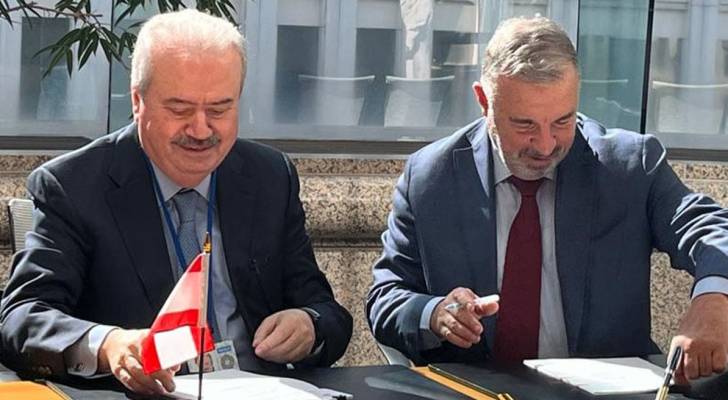

Finance Minister Yassine Jaber (left), Jean-Christophe Carret, World Bank’s regional director for the Middle East (right)

Lebanon signs $250 million World Bank loan to address electricity crisis

Lebanon has secured a USD 250 million loan from the World Bank to help address its chronic electricity shortages, the Finance Ministry announced Thursday.

The agreement was signed in Washington by Finance Minister Yassine Jaber and Jean-Christophe Carret, the World Bank’s regional director for the Middle East. The loan is intended to support critical reforms and boost the reliability of Lebanon’s electricity supply.

“This loan will significantly support Lebanon’s reform efforts in the electricity sector,” said Jaber.

Carret called the signing a “turning point” in the World Bank’s partnership with Lebanon, and a step toward long-delayed reforms. He noted this is the World Bank’s first loan through the International Bank for Reconstruction and Development (IBRD) specifically for Lebanon’s electricity sector.

The project includes the development of scalable solar energy farms, with the first phase expected to produce 150 megawatts and save Lebanon around USD 40 million per year in fuel costs. It will also fund the creation of a new national control center and improvements to the billing and collection systems at Electricité du Liban, the state-run power company.

Minister Jaber is in Washington leading a Lebanese delegation attending the IMF and World Bank Spring Meetings.

Lebanon has struggled with electricity shortages for decades. Public and private power sector debts have reached an estimated USD 40 billion, and past governments have failed to implement lasting solutions. The country’s existing renewable energy projects—mostly small-scale—generate only 1,400 megawatts.

Lebanon’s thermal and hydroelectric plants can produce around 3,000 megawatts under ideal conditions, covering just 30 percent of the country’s electricity demand.

Since 2019, Lebanon has been in the grip of one of the world’s worst economic collapses, marked by a banking crisis, fuel shortages, and widespread poverty.